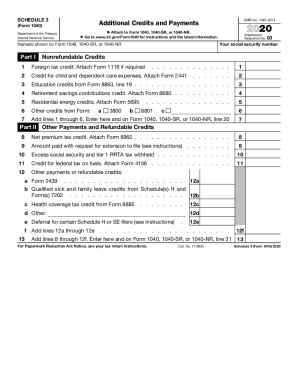

Schedule 3 1040 2024 Instructions – These limits are noted in the table below for both the 2023 and 2024 3. Internal Revenue Service. “Schedule C: Profit or Loss from Business,” Page 1. Internal Revenue Service. “2022 . The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024 on the standard Form 1040. It includes sections for .

Schedule 3 1040 2024 Instructions

Source : www.dochub.comTax season is under way. Here are some tips to navigate it. – WAVY.com

Source : www.wavy.comIRS 1040 Schedule 3 2020 2024 Fill and Sign Printable Template

Source : www.uslegalforms.com1040 (2023) | Internal Revenue Service

Source : www.irs.gov2023 schedule 3: Fill out & sign online | DocHub

Source : www.dochub.comOhio Taxation on X: “IT’S HERE! 🎊 The 2024 Tax Instruction

Source : twitter.com1040 (2023) | Internal Revenue Service

Source : www.irs.govTax Time FAQs 2024 – CJM Wealth Advisers

Source : www.cjmltd.comTax season is under way. Here are some tips to navigate it | AP News

Source : apnews.comWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.comSchedule 3 1040 2024 Instructions Schedule 3: Fill out & sign online | DocHub: This is reported on Schedule E for an individual’s tax return filed on Form 1040 or 501(c)(3) of the tax code. For more on qualifying as an S-corp, see the instructions to Form 2553. . For 2023, the $600 threshold is delayed the companies to report payments on 1099-Ks and a $5,000 threshold is planned for 2024 of a 1040 form, which is reported on line 8 of Schedule 1. .

]]>